What’s happening with the biosimilar market?

Numerous articles and analysts’ reports have trumpeted biosimilar market growth, citing rising sales in the US and success stories from across the pond. But the goal of biosimilars is to reduce the cost of older biologic drugs the same way generics do for branded small molecules. Evidence of this would be that nearly all volume shifts rapidly to lower priced once the innovator’s market exclusivity has expired, and net prices fall rapidly and considerably. Instead, today’s market presents neither of these features, especially as biosimilar manufacturers are incentivized to price high.

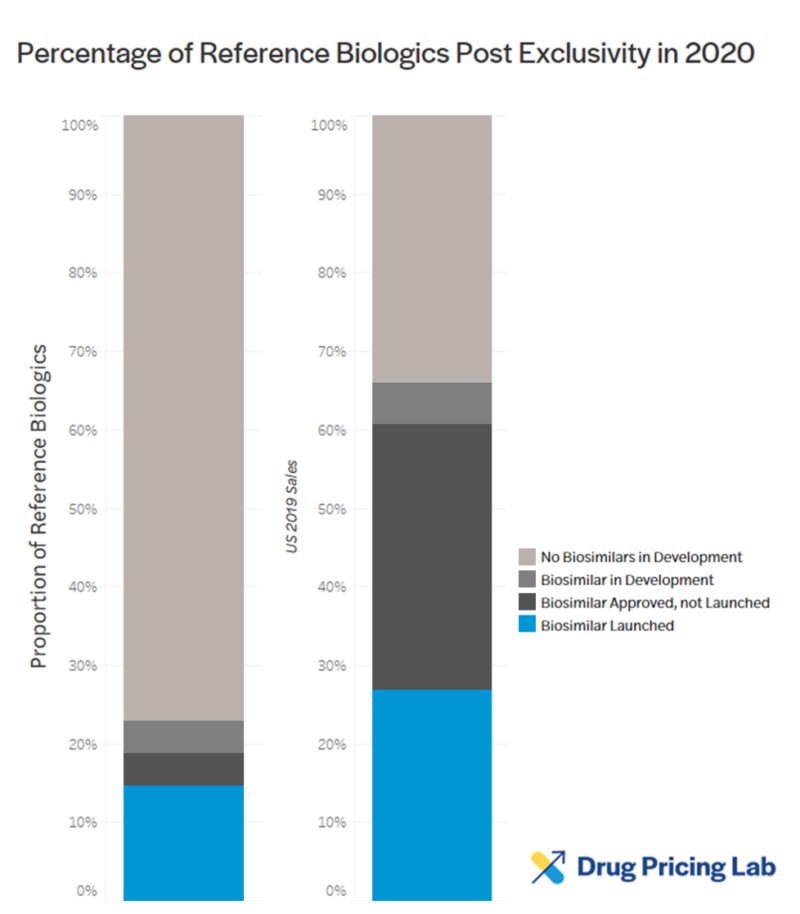

Eligible post-exclusivity biologics must face competition, but most aren’t (and likely won’t)

Few biologics past their exclusivity date face biosimilar competition, or even the prospect of it. According to a recent report by IQVIA, only 22 additional molecules have biosimilars in development whereas 153 reference biologics do not yet have any in development. Of the biosimilars approved in the last five years, originator molecules generated an average of over $5 billion per year at their peak.

Biosimilars must lower the price of biologics, but they don’t

The average discount offered by biosimilars at market entry for 5 drugs facing new biosimilar competition in the last two years (Avastin, Herceptin, Rituxan, Neulasta, and Epogen) was less than 10%. Originators continue or even accelerate their price increases once biosimilars are filed with the FDA.

Some biosimilar entry can take place, and some discounts can be reported, and yet the policy can still fall massively short of its savings objective

Biosimilar operating margins are more like branded drug makers than branded commodity manufacturers

Amgen, Biogen, Merck, Novartis, and Pfizer have all launched or plan to launch biosimilar products. This is a sign that the biosimilar market itself is lucrative enough for multi-national drug companies to dominate. The median operating margins for global branded pharmaceutical and biotech companies are over 30%, which is a good indicator that these companies see comparable margins in the biosimilar market.

Conclusion

Structural obstacles to truly competitive biosimilar entry are still present in the US market, just as they were about two years ago. But policymakers are not stuck with biosimilar market competition as the only means of driving down prices for biologics. Production Plus Profit Pricing (P-quad) has numerous features worth considering.

Download the full report here.